Want access to some of the largest programs in the world at a lower entry point? Typically, investment options come through either a separately managed account with high minimums or a fund product with limited liquidity and less flexibility than a standard futures account. A managed account platform bridges this gap by offering increased liquidity, daily transparency, notional funding, and, importantly, a lower entry point. This provides an avenue to diversify across multiple managers even if an investor does not want to allocate millions to the asset class. So how does it work?

All futures accounts trade through a futures commission merchant (FCM) in a separately managed account (SMA) structure. We can easily recognize big names, including JP Morgan, Goldman Sachs, Citigroup, and others that cater to institutional clientele. Meanwhile, high-net-worth individuals and family offices use firms like ADM Investor Services, RJO, and StoneX. Investors who choose the SMA route see all trades, get daily reports and can monitor every dollar of movement in their account. Strategies can typically be opened or closed on any given day. While every CTA sets a trade level, investors can choose to fund with less than the stated amount and utilize leverage. We discussed how this works in our article on Understanding Minimum Investment Sizes.

A fund account is set up using a single SMA that brings investors into a pooled vehicle. While the company running the fund can see the daily trades, investors often see just daily or monthly returns. Liquidity is limited by rules on when investors can enter or redeem. In some instances, the operating group may choose to utilize leverage, but depending on the type of fund, this ability is limited. Investors do not get a say in how aggressively they want their investment to be traded. Account owners in these vehicles can only lose what they put into the fund, which limits their liability compared to a separate account.

Finally, we come to the third option, the managed account platform (MAP). Here the account begins like a fund with a separate account trading a specific strategy. Since they target larger managers, this initial amount might be $5-$10 million or more, requiring a seed investor. This could be the manager themselves, a pension fund, or a family office that wants to utilize the benefits of this hybrid structure. Additional investors enter following this lead and are pooled with the other investors. But unlike a fund, the investor is given choices at this point. Since the SMA is already established, the trader can trade any amount over the minimum account size. This means that a new investor can enter with just $100k, AND since they are just given a trade level, the investor has the option to trade with leverage. In practice, this means that they could invest $200k and trade it at a 2x multiple ($200k x 2= $400k) and divide their allocation across four managers at $100k each. Since trade levels are easier to adjust in an SMA, they also get weekly liquidity and daily valuations for each manager. Like a fund, they also limit their liability to the amount they deposit, even if they trade with leverage.

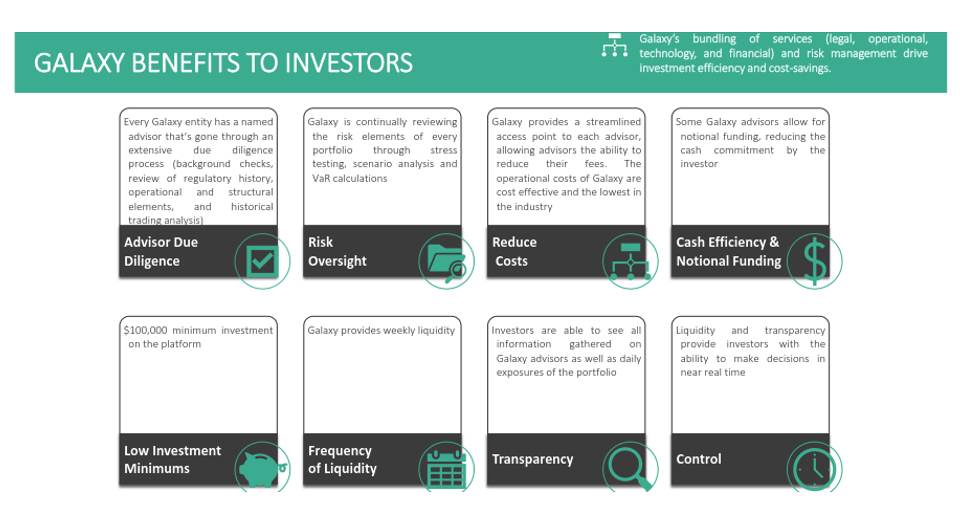

Galaxy is one such group offering a managed account platform. They summarize many of these advantages in the chart below.

Marc Lorin, CIO of New Hyde Park Alternative Funds, LLC, the sponsor of the Galaxy Plus Fund, LLC managed account platform, says this about investor motivations for utilizing their services:

“Institutional investors appreciate the value-proposition of a managed account platform like Galaxy because it streamlines their investment process and removes some of the liability of operating a managed account while preserving most of the advantages of doing so.”

With assets over $2b, managers also utilize the platform to reach new audiences, comply with mutual fund structuring rules, and outsource their fund’s operation.

The volatility over the past few years, from the pandemic to the Fed’s reaction to it, and now the painful repercussion of inflation on our investments proves the value of diversification. Managed account platforms can be a potential tool to build a better portfolio in this arsenal. After all, we may not calm down anytime soon.

Please reach out for more information on this or other options to add diversification. We are happy to provide guidance at no cost to you.

Photo by Graham Holtshausen on Unsplash