The VIX, or Volatility Index, is one of the most frequently mentioned acronyms in financial news. This prominence is well-justified, given that the VIX serves as a crucial indicator of market risk and is instrumental to the pricing of options, which exerts a profound impact across the financial landscape. Furthermore, trading activity related to the VIX is on the rise, with numerous ETFs and VIX futures offerings now catering to investors seeking opportunities for profit or portfolio hedging. The VIX stands out as a unique instrument tailored for both purposes that traders highly covet. It displays significant upside potential during market downturns while also exhibiting predictable behavior in stable or stagnant market conditions.

The Double-Edged Sword of the VIX

Nevertheless, the VIX’s inherent variability creates a double-edged sword. Sudden spikes in the VIX can either make or break an entire trading year, depending on the trader’s position. The futures contract’s value of $1,000 per point complicates the sizing of contracts for individual accounts, presenting traders with hurdles to overcome. In response, the Cboe Futures Exchange (CFE) introduced the Mini-VIX contract, which follows the successful model of the E-mini and Micro S&P futures. This move provides investors with greater flexibility in shaping their trading strategies and caters to a wider range of risk appetites. All this while keeping true to the innovation-focused mission of the Cboe.

Understanding the VIX Index

The VIX index is a subject of widespread misunderstanding, with many assuming it to be a real-time barometer of current market movement. In reality, the VIX is forward-looking, reflecting expectations of future volatility. It achieves this by measuring the willingness of option sellers to offer puts and calls, as dictated by the prices they demand from buyers, and assigning a value to it. Consequently, the VIX considers the current market conditions and investor expectations. For example, if an impending event, such as a Federal Reserve meeting, is poised to disrupt the market, there may be greater demand for options than supply available, causing prices to rise. This leads to a corresponding increase in VIX futures until a market-clearing level is attained. Other events, like elections, earnings reports, or geopolitical issues, can also trigger similar responses as traders seek protection or profit opportunities.

VIX Contracts and Market Dynamics

VIX contracts typically remain in contango, with higher prices further out on the time scale than near-term prices. This is logically driven by the higher likelihood of market disruptions occurring at any point in the next six months compared to the next thirty days. This can change quickly as a current event might cause panic, forcing investors to flee to protection quickly. The COVID pandemic serves as a prime example of this phenomenon as a period of relative calm abruptly transitioned to massive sell-offs, pushing the VIX from the mid-teens to above eighty. Commodity Trading Advisors (CTAs) holding long positions in the VIX offered crucial protection to their investors. Nevertheless, benign market conditions can mislead investors into thinking that a long-term holding of a short VIX position is safe. The ‘Volmageddon’ event of 2018 serves as evidence where short VIX ETFs were caught off guard by a spike, necessitating swift exits from their positions and driving the index to soaring heights.

The chart below illustrates the inverse relationship between the S&P and the VIX, showcasing the profound impact of COVID-related fears on global markets.

CFE’s Innovation and Market Tools

Given its propensity to move quickly, it makes sense that this instrument is most often traded by professional investors. Advanced strategies that account for this possibility through spreads, systematic trading, or a combination of options and futures often perform the best. The large contract size, however, forced many on the futures side to either avoid the trade altogether or only use them in very large accounts. CFE, “the home of volatility and corporate bond index futures,” recognized the need for CTAs to allocate more precisely within separately managed accounts (SMAs). Additionally, they aimed to facilitate the real-world testing of strategies with a smaller, more accessible option.

Introduction of the Mini-VIX

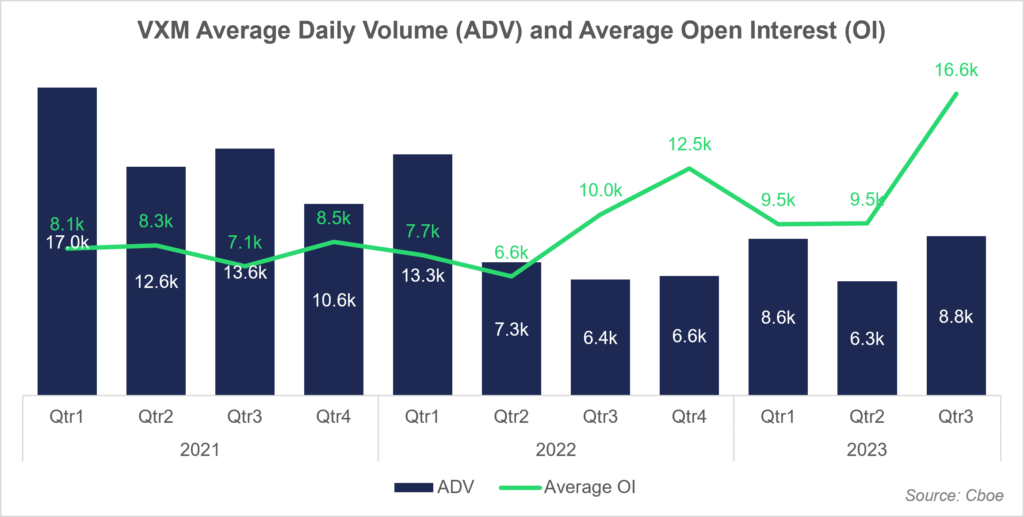

Their solution to this challenge comes in the form of the Mini-VIX, which operates at a $100 per point increment (1/10th the size of the standard VIX contract). This aligns with the widely popular VIX equity options product offered by CFE and empowers investors to engage with the market more effectively. A hypothetical example could be a CTA that uses one VIX contract per $100k trade level. Once they gain $50k, they could either use two VIX positions and be overweight or none and be underweight. The new option allows them to add five Mini-VIX contracts to stay within their model. While trading volume has seen a slight decrease since the launch of the Mini-VIX, the open interest remains notably high, suggesting a sustained interest in the instrument. An important development to note is the adjustment of the tick size, which was reduced from 0.05 to 0.01 in October 2022. This change is a significant catalyst for reduced bid-ask spreads, further enhancing the appeal and accessibility of the Mini-VIX to traders and investors.

- VXM Futures average daily volume (ADV) and average open interest (OI)

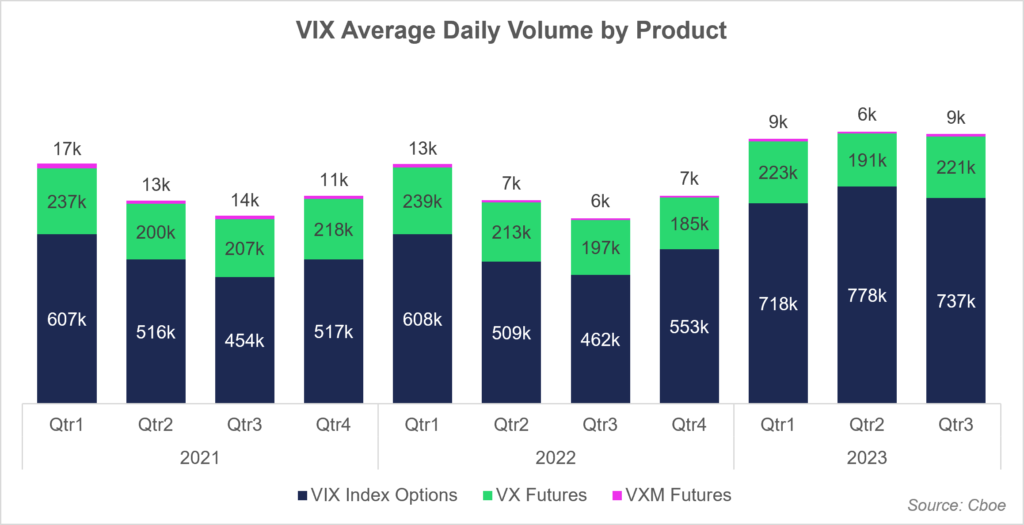

- Cboe Global Markets products ADV – Futures (VX and VXM) and Equity Index Options (VIX)

Adapting to Economic Turbulence

Expanding flexible options for traders and investors proves to be a win-win scenario in the grand scheme of things. Pioneering entities like CFE consistently push the boundaries of innovation by introducing novel products like the Mini-VIX or their corporate bond futures products, which track both investment grade and high-yield bond ETFs. These offerings serve as invaluable tools, especially in the current landscape where the US Federal Reserve is vigorously combating inflation through higher interest rates to adapt to new realities. In such times of economic turbulence, the ability to access a broader array of tools is instrumental in risk mitigation and capitalizing on market dislocations.

Uncertainty is a constant presence in the world of financial markets, but astute investors leverage this unpredictability to their advantage. With these new, precision-driven tools at their disposal, they are even better equipped to navigate the ever-shifting financial landscape and seize opportunities as they arise.

“Cboe Futures Exchange (CFE®) is the home of volatility and corporate bond index futures. CFE is owned by Cboe Global Markets, and trades on CFE are cleared by The Options Clearing Corporation® (OCC). “

BNN Bloomberg: 2018 Volmegeddon