In 1971 President Nixon imposed a 90-day wage and price control program and other various expansionary fiscal policies in what became known as the “Nixon Shock”. More importantly, Nixon closed the gold window to prevent foreign governments that had been holding dollar-denominated financial assets from demanding gold in exchange for their dollars. By January 1976 a G-7 agreement ended the formal role of gold as the principal reserve asset, legitimizing the de facto system of fiat currencies and floating exchange rates.

The reason for retelling this story is because these events led to the formation of the gold leasing market during the mid-1980s. Gold loans evolved as a means for central banks to earn a return on their bullion inventories to cover the cost of warehousing bullion by loaning gold in exchange for a lease rate. This market developed quickly and grew throughout the 1980s and 1990s. When bullion drifted below $300, the gold carry trade came to dominate the derivatives markets. Gold’s steady appreciation since 2002, however, has rendered this trade obsolete. As a result, there has been a wholesale transformation in the gold market.

So how is this background applicable to the average investor? Recognizing that gold incurs a cost-of-carry and does not provide income, the question is if there is a method by which investors can earn income on their gold holdings? Cervino Capitalmay have provided an answer by developing their Gold Covered Call Writing program which captures option premium from writing calls against long gold futures.

Most CTA programs are active traders—in fact, one could say that the primary source of returns in managed futures is skill-based. The problem with a pure trading approach, however, is that it doesn’t provide an asset-based exposure/return (ie, beta) that investors may be seeking to diversify their overall investment portfolio and enhance their investment “efficient frontier”. Not so with the Gold Covered Call Writing program, the strategy maintains a perpetual long-only gold futures position which essentially duplicates exposure to gold prices.

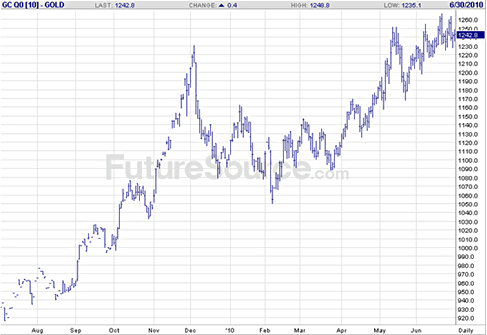

There is also another dimension to this strategy which is risk-adjusted returns which come from using call and put options to both generate income and provide downside risk protection. A great way to understand how such an approach can provide risk-adjusted performance is to compare the returns of gold ETFs with the returns of the Gold Covered Call Writing program. But first, let’s take a look at the chart below which shows just how volatile gold has been in the last few months:

As you can see, gold started to get bullish in September 2009 and then “frothy” during November. In December 2009, however, gold prices dropped dramatically and then entered into a very choppy range which continued until April when it resumed its bullish trend topping out around 1260.

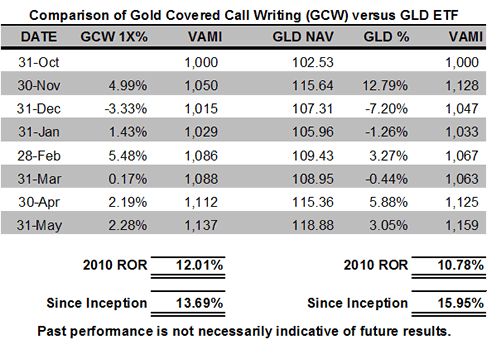

Recognizing that past performance is not necessarily indicative of future results, here is a comparison of the performance returns between the most popular gold ETF, SPDR GLD Trust, and the fully-funded version of Cervino Capital’s Gold Covered Call Writing program since inception through May 2010:

What is notable is that in three out of six periods GLD suffered down months while the Gold Covered Call Writing program only suffered one down month in December 2009. And with the exception of November 2009, April and May 2010, periods when underlying gold was very bullish, this strategy outperformed every other period with far less downside volatility. How can this be the case?

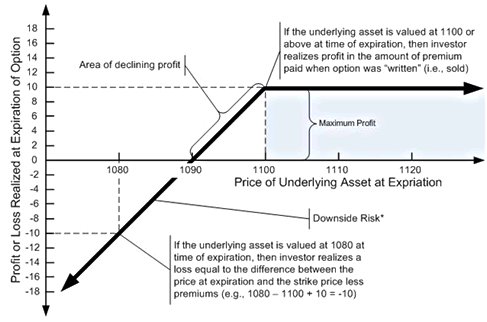

The answer is in the use of options, specifically the “covered call writing” strategy. Covered call writing is the name given to the strategy in which one sells a call option while simultaneously owning the underlying asset. This approach works best in a mildly bullish or neutral market conditions, and even incorporates limited insurance to the downside if the asset declines somewhat.

Since the program launched it has been capturing between 3% – 4% in net premiums per expiration cycle. In the real world, however, gold prices are volatile and go down as well as up which in turn will impact the overall returns of the program. Nevertheless, it is expected that the premiums captured from writing calls will over the long run reduce volatility, and so far that has been the case.

One thing to note, however, is that the covered call strategy does limit profit potential as the graph above shows. Accordingly, investors may not fully participate in a strong upward move like what happened to gold in November 2009, unless the call option is rolled to a higher strike. This is where the skill-based aspect comes into play with the CTA making such trading decisions. Part of this discretion includes the purchase of puts which acts like insurance in order to further protect downside volatility.

There is still another aspect of this program which makes it much different from gold ETFs. Institutional investors like to be efficient with the use of investment capital and thus often use leverage to achieve their goals. Given current prices, in order to have the same exposure as one gold futures contract you would have to invest around $125,000 in the GLD ETF. The Gold Covered Call Writing program, however, achieves the same exposure with just a $50,000 investment resulting in approximately 2:1 leverage. It is also possible to capitalize an account with $25,000 actual cash and $25,000 notional funding.

That said, it should be noted that the use of leverage can work both for you and against you, and investors should first make sure they fully understand this important factor when investing in managed futures. If you want to learn more about the use of margin in managed futures, please contact your broker.

Until the millennium there were only a few ways to invest in gold and silver. One could purchase the physical asset in the form of bullion, coins or jewelry; you could invest indirectly vis-à-vis mining stocks or related companies; or you could trade precious metals futures contracts. There is, however, another way of investing in metals called managed futures. Sophisticated investors have long known about managed futures as an arena in which to obtain skilled-based returns from professional money managers.

In line with such thinking, Cervino Capital’s Gold Covered Call Writing managed futures program offers an innovative approach to adding gold to an investment portfolio. In addition, while the program charges a 2% management fee, it does not charge an incentive fee, making it a cost competitive alternative to gold ETFs. For more information, download Cervino Capital’s disclosure document from our website.

PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS. INVESTING IN FUTURES AND OPTIONS INVOLVES RISK AND MAY NOT BE SUITABLE FOR ALL INVESTORS. THEREFORE, INVESTORS SHOULD CAREFULLY CONSIDER THESE RISKS AND DETERMINE WHETHER THEY ARE SUITABLE FOR INVESTING IN LIGHT OF THEIR FINANCIAL CONDITION AND INVESTMENT OBJECTIVES.