Some may feel they are overloaded with news and it is just noise. Well, some new machine learning research suggests that following new is worth a second look. The news can provide a strong measure of sentiment that can improve forecasts versus using traditional fundamental information. This news sentiment is also unique and can add value versus survey sentiment information found in the long-serving Conference Board and University of Michigan work. This new research on sentiment is presented in the paper, “Measuring News Sentiment” from the Federal Reserve Bank of San Francisco.

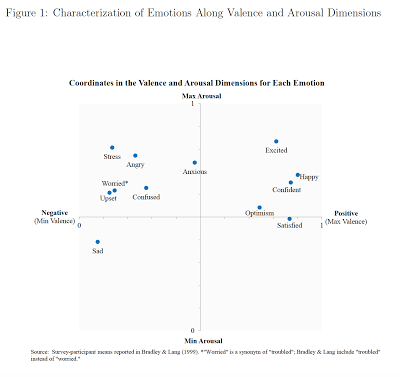

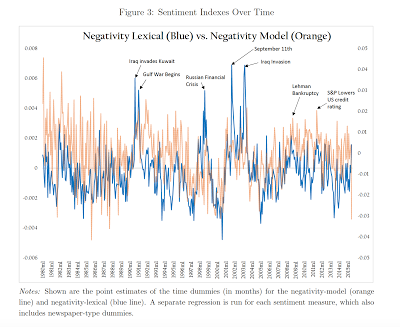

This work is important for those who want real time survey estimates and have started to employ nowcasting type of approaches to market predictions. The researchers looked at news articles from 16 major newspapers through LexisNexis from 1980 to April 2015. They use a lexical or “bag of words” approach and a machine learning approach through the use of natural language processing. The focus is to measure sentiment on two dimensions valence (positive or negative stories) and arousal (activation or deactivation stories).

Using a number of statistical measures to determine the quality difference in models, the authors are able to conclude that using sentiment is better than just employing economic data. The use of news sentiment is also superior to models that employ the traditional survey data followed by many economists and investors.

We cannot tell how sensitive this work is relative to other data formations, but the fact that a natural learning model and a lexicon-based model both show the value of sentiment suggests that there is something interesting here. The sentiment can be as simple as greater focus on pessimism and optimism, but it can add value.

Don’t lock yourself in a room to separate yourself from the news. Follow the news and you may get a feel for where the economy is going based on the fact that the news embodies the view of many economic actors. The sentiment of these actors has real effects.