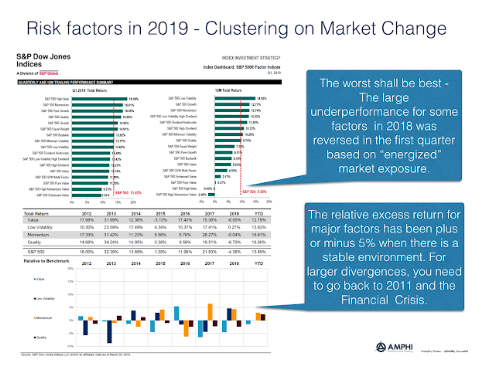

An analysis of the first quarter tells us a lot abut factor investing in the short-run. Foremost, the worst factors last year are the best for this year. Factor risks change with the market environment as shown through the global factor indices from S&P Dow Jones. Factor rotation occurs, but not clear that it is predictable. Factors effects also can be swamped by the impact of large macro events.

Additionally, the relative gain or loss through investing in factors over time can be range bound when there is not a turning point in the business cycle. The value of factor diversification will be appreciated during periods of dislocation.