Everything you have heard about yield curve inversion is true; nevertheless, everything that is true may not harm your investments. Yield curve inversion is a good predictor of recession, and there is a link between this inversion, recession prediction, and equity declines. However, being the first to react to flattening or inversion may not win your portfolio success.

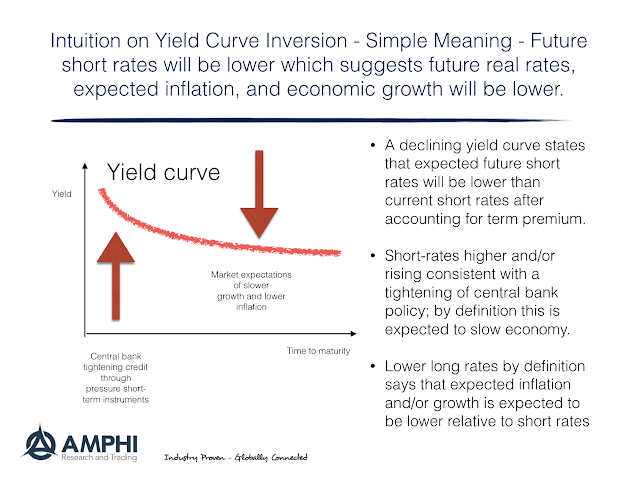

The critical question is determining what the inversion signal represents between current and longer-term expectations. In simple terms, short rates tell us something about current Fed policy, currently expected inflation, and recent economic growth. Longer rates tell us something about Fed policy, expected inflation, and current economic growth, but over longer horizons.

Hence, after accounting for any term premium, the steepness or inversion of the yield curve tells us something about relative expectations, no more or no less. A greater yield slope translates to more significant divergence between short and longer-term expectations. An investor has to ask the simple question, “Do I agree with the relative expectations in the curve?” Given what the market is telling you, the next question is whether you should act on this view today. An inversion in this framework should be viewed dispassionately.