Knowledge is the Treasure, but Judgment is the Treasurer of a Wise Man. He that has more knowledge than Judgment, is made for another Man’s use more than his own.

-William Penn

My father used to tell me that brains are like muscles: they can be hired by the hour. It is character and judgment that are not for sale.

-Antonin Scalia

Markets are efficient in the sense that it is hard to generate excess returns. Information is readily available and employed so there is an immediate reaction to any new information event. There are very few funds which have to ability to obtain new information, certainly not legally, or create new information. A recent exception has been using news story counts and twitter hits as a source of data, but the number of firms employing these strategies has increased significantly in the last few years.

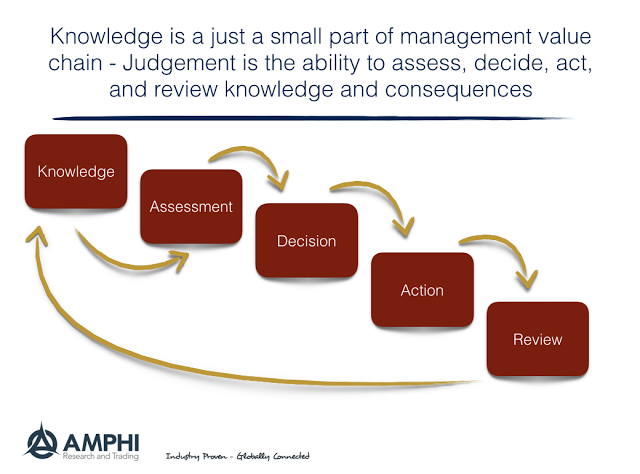

The quality that separates managers is not data but the judgment on how to use or manipulate data to tell a better forecast story than what is discounted in market prices. A key part of judgment is the assessment and weighing of facts in order to tell a coherent story of what may happen in the future relative to the opinion of others.

So what makes good forecast judgment? It could be quantitative or discretionary, but it is founded on the interpretation of facts not the gathering of facts. For interpretation, there is a need for a philosophy or view on how the world works. Many can have facts but the assessment of these facts is the value-added skill.

The assessment or narrative with the facts, however, is not enough. There also needs to be a decision and action. An assessment without action is of no value to the investor. The assessment has to be converted into a decision which one can call a bet and the action of taking the bet and placing it in the market.

Along with the action, there needs to be a review and feedback. A manager’ skill is not just taking the same bet when given a set of facts but learning if the markets have changed and adjusting so the decision process or judgment is improved.

The triplet of assessment, action, and review is the manager’s judgment and the skill for which investors should pay. Hence, the focus or assessment on skill has to be on the judgment value chain.